Atlantic Money secures additional funding & goes live in the UK

July 21, 2022

Atlantic Money’s low cost money transfer service is now available to everyone in the UK via the Atlantic Money iOS App.

First time people in UK can send up to £1m abroad for £3 and no FX mark-up.

The firm secured an additional injection of $3m seed capital, led by Amplo.

Atlantic Money has today announced that its low-cost money transfer service is now available to everyone in the UK, saving them up to 99% on their cross-border payment costs. The firm has also secured an additional injection of $3m seed capital to supercharge its international growth having recently received its EU licence.

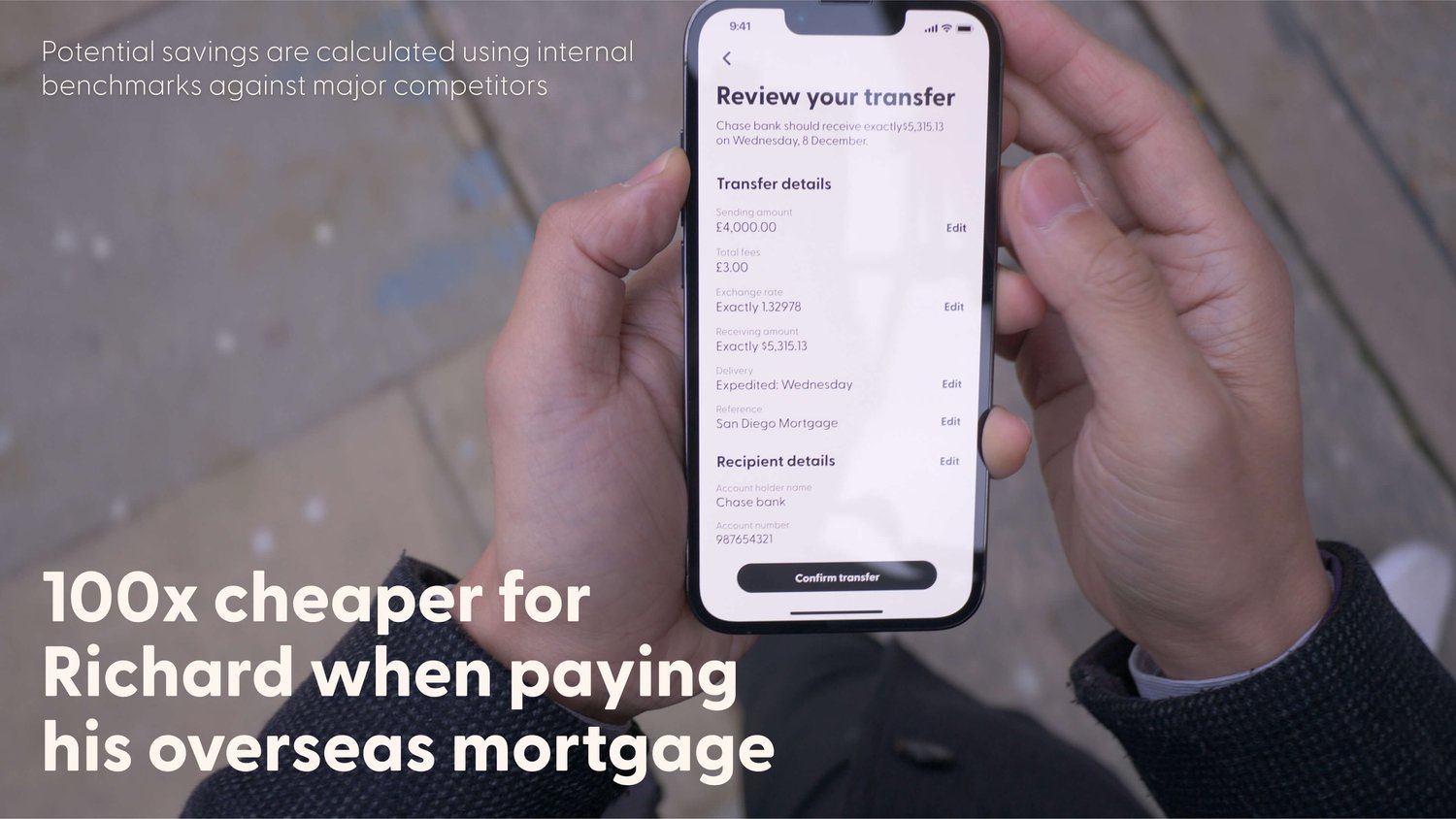

For the first time, people in the UK can transfer up to £1,000,000 abroad for a fixed fee of £3 and at the interbank mid-market rate with no foreign exchange (FX) mark-up. The low-cost transfers can be made via the Atlantic Money iOS App.

The further $3m in seed funding was led by Amplo and included Nordstar and former Lazada executive, Martell Hardenberg. This is in addition to $4.5m in initial seed funding from investors including Index Ventures, Ribbit & Kleiner Perkins.

Simple, slick and cost-effective money transfers

Atlantic Money’s app is the most simple, slick and cost-effective way of moving money across borders. The fixed flat fee of £3 undercuts incumbent money transfer providers and saves customers 75% compared to the firm’s nearest priced competitors, like Wise – and up to 99% when compared to other providers like PayPal, Western Union, OFX and Co.

Users simply download the app, go through a one-minute verification process, and can immediately begin transferring money. They can select standard delivery or opt for express delivery for a small additional fee of 0.05% – a £1,000 express transfer costs just £3.05.

Customers can send money from the UK in GBP into 9 currencies including USD, EUR, AUD, CAD, SEK, NOK, DKK, PLN and CZK, with new currency corridors and advanced product features being added continuously post-launch.

“The previous generation of challengers like Revolut and Wise disrupted the banks, bringing better technology and lower fees. But they have since lost focus and abandoned the very product that made them great in a quest to build the next ‘super app’. We are disassembling this approach by being laser-focused on doing one thing better than anyone else – getting people’s money from one currency and country to another, as efficiently as possible. We are grateful to our current and new investors for their continued support and excited to provide our UK customers with a best-in-class customer experience and unmatched cost savings.”

— Patrick Kavanagh, Co-Founder of Atlantic Money

“Large financial institutions move unlimited money around the world at effectively zero cost and secure the live exchange rate by working directly with one another. Meanwhile, retail customers are charged progressive fees and unjustifiable exchange rates. We are democratizing pricing previously reserved for the banks and drastically cutting the cost of larger transfers by up to 99% lower than all other money transfer companies.

We are already seeing some fascinating use cases and delivering substantial cost savings for our customers. For example, a customer recently purchased a property in mainland Europe and sent the equivalent of €200,000 from the UK – they saved 98% compared to Wise.”— Neeraj Baid, Co-Founder of Atlantic Money