Backed by Some of the World’s Best

March 9, 2022

Helping Atlantic Money execute on its mission are some of the world's best investors including Amplo, Ribbit, Index Ventures, 20VC, Kleiner Perkins, Elefund, Susa Ventures and Day One Ventures.

Vlad Tenev and Baiju Bhatt, the founders of Robinhood, & Anquan Wang, founder of Webull, also invested.

Here is what some of our backers had to say about why they wanted to invest in Atlantic Money:

“Atlantic Money is a second generation challenger, disrupting not only banks but the first generation of fintechs that are now part of the establishment. It’s refreshing that Atlantic isn’t building another financial super app with vast product features irrelevant for their target customers - instead, they are laser-focused on eliminating disproportionate fees and margin for people sending large amounts of money abroad, while making the process incomparably simple.

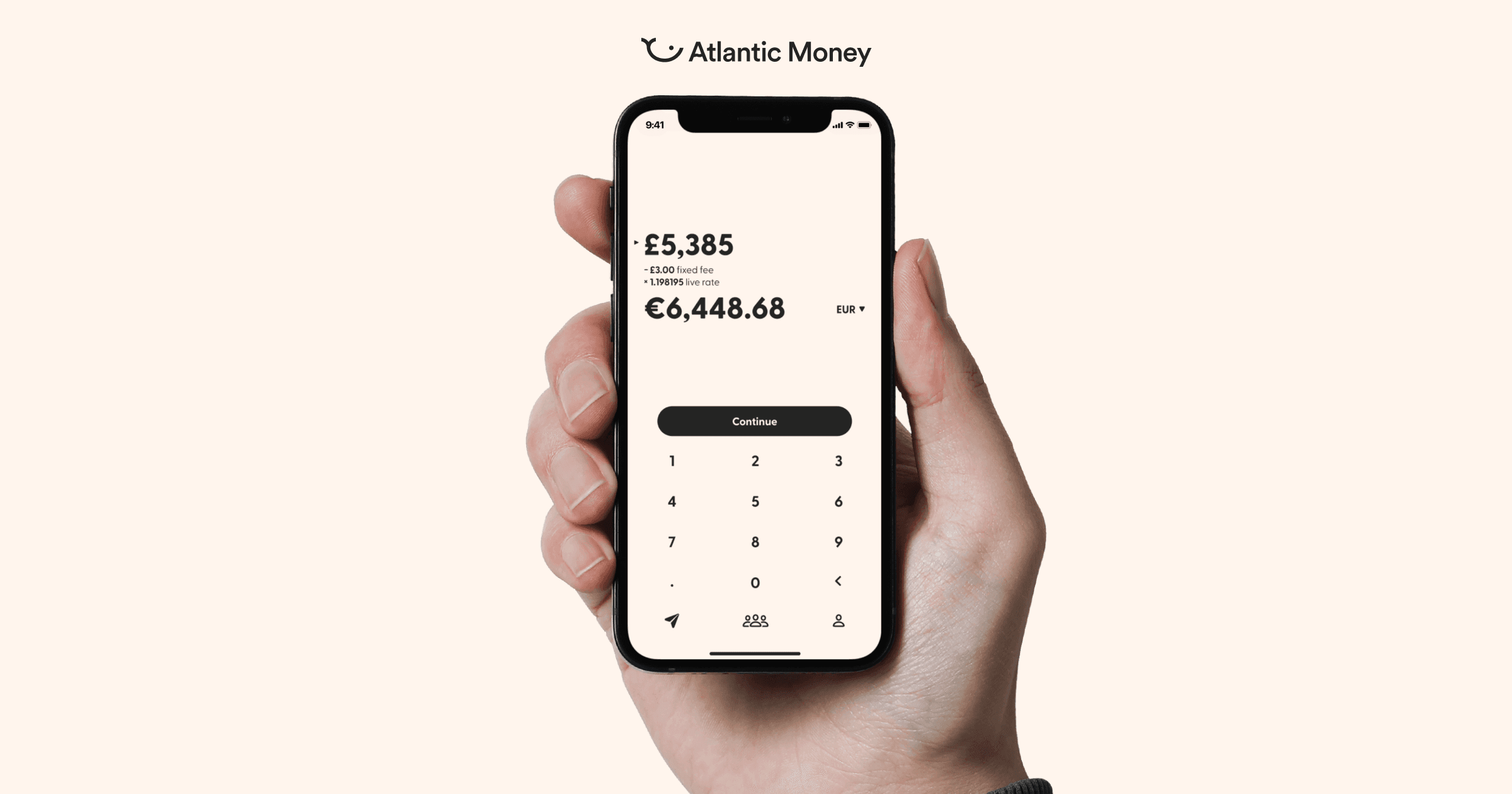

There isn’t one other provider today that enables you to send up to £1 million abroad for just £3 with no FX commission. That’s pretty impressive.”— Harry Stebbings, Managing Partner at 20VC

“Atlantic Money is laser-focused on eliminating excessive fees for people regularly sending money abroad, while making the user experience frictionless. The digital innovation of the past decade has started to disrupt the money transfer market, but more than 90% of customers globally still use legacy solutions. Even those using modern solutions are charged opaque volume-based or tiered fees that can change over time and across geographies. Atlantic’s novel approach gives customers a simple, transparent fixed fee per-transaction, with zero FX markup, no matter when or where customers are sending their money or how much they are sending. This dramatically undercuts the incumbents, particularly for customers sending significant amounts abroad.

Patrick, Neeraj and team have deep experience working in fintech. As leaders in the first wave of innovation that has started to change the financial services landscape, they understand the complexities of running regulated, compliant businesses and also the opportunity to use technology to bring greater value to consumers. We’re excited to see them using that expertise to create products that deliver even more transparent and lower-cost financial services in a critical part of the market.”— Nick Shalek, General Partner at Ribbit Capital

“Amplo has a long-standing relationship with Patrick and Neeraj, who were stars at [Amplo portfolio company] Robinhood. Their maniacal focus on user research, product and markets has uncovered a compelling opportunity to deliver beautiful products tailor-made for the fintech sector’s most valuable customers. We are excited to partner with Atlantic Money on their mission to create a stable of best-in-class financial products for power users - and if their new money transfer solution is anything to go by we think the opportunity looks massive, as are the benefits for their customers.”

— Sheel Tyle, CEO at Amplo

“Patrick and Neeraj are exceptional at understanding customers. Atlantic, which is a direct result of their user research, is an example of that.

Between their raw talent and tireless pursuit of unconventional solutions, these two are a formidable team who are taking on a market ripe for disruption.”— Nathan Rodland, General Partner at Elefund