Atlantic Money Emerges From Stealth

March 9, 2022

Atlantic Money, a new money transfer provider is bringing institutional pricing to people sending larger amounts of money abroad, dramatically undercutting the pricing model of incumbent providers.

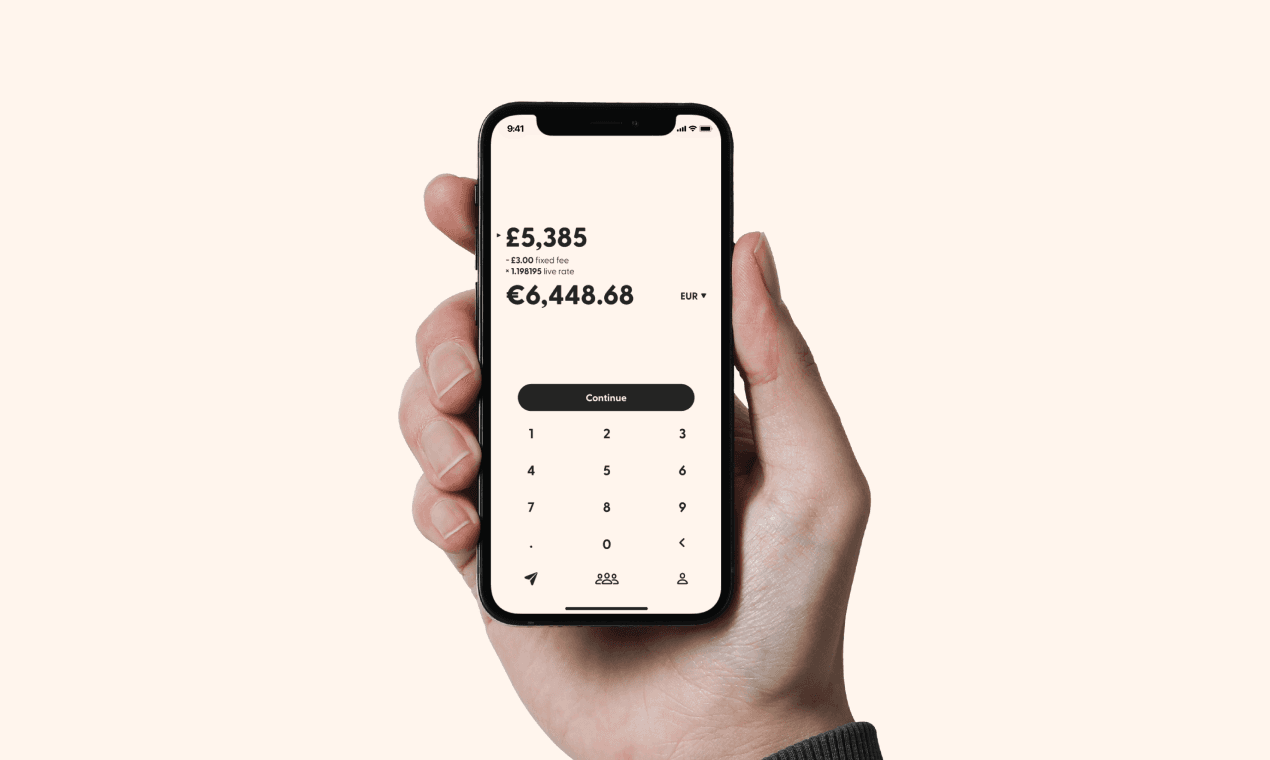

For the first time, customers can send up to £1 million per transfer whilst securing the live mid-market currency rate for a flat fixed-fee of £3, enabling savings of up to 99% versus existing services.

Co-founders Neeraj Baid & Patrick Kavanagh were early employees of trading platform Robinhood.

Amplo & Ribbit Capital led Atlantic Money’s $4.5m seed funding round, with participation from Kleiner Perkins, Index Ventures, Harry Stebbings’ 20VC, Elefund, Day One Ventures & Susa Ventures.

Vlad Tenev and Baiju Bhatt, the founders of Robinhood, & Anquan Wang, founder of Webull, also invest.

Atlantic Money has today emerged from stealth with a mission to bring equality to the global money transfer market. As American expats in London, co-founders Patrick and Neeraj wondered why, more than a decade after the emergence of the first fintech challengers, they were still being hit with £100's in exchange rate fees for a service that was largely automated.

As they researched the global FX market they discovered that big institutions move unlimited money around the world at effectively zero cost, securing the live exchange rate by working directly with one another. The progressive fees that retail customers are being charged by existing money transfer providers do not exist - in fact, the cost of sending money internationally is largely fixed per transaction, even when sending large amounts.

Yet the incumbent money transfer providers have built businesses dependent on penalising the customers who need them most - because the more you send, the more you pay. Customers who have family or financial commitments abroad such as mortgages, credit cards, investments, tuition fees are sending thousands of pounds per month, while being charged unjustifiable fees.

Atlantic Money is putting an end to this. With a friction-free app, plus a technology platform that cuts out the middleman, it directly connects everyday customers to an institutional-grade currency transfer solution. Now, pricing previously reserved for the banks will be available to regular customers, making the cost of £1,000+ transfers with Atlantic Money lower than all other money transfer providers on the market.

Atlantic Money is the only international money transfer provider to offer the live mid-market currency rate and a flat fixed-fee of £3 for transfers all the way up to £1,000,000.

At launch, the app will enable customers to send money from the UK in GBP into 9 currencies including USD, EUR, AUD, CAD, SEK, NOK, DKK, PLN and CZK, with new currency corridors and advanced product features being added continuously post launch.

Atlantic Money customers can expect:

A £3 flat fee on transfers all the way up to £1,000,000

The real, live interbank exchange rate (0% FX commission)

Savings of up to 99% vs providers inc. Paypal, Wise, and Western Union

Standard delivery takes just a few days, with Express delivery available when needed

Simple, fast, and secure global money transfers in a frictionless app

Atlantic Money is accessible to anyone transferring money abroad, but its core focus is to facilitate substantial cost-efficiencies for people sending sums over £1,000 who are currently getting the worst deal:

“Sending money abroad should be simple, fast and low-cost. We’ve built Atlantic Money from the ground up to deliver on these objectives and aim to be the logical default option for customers who send larger amounts of money overseas regularly. This market has evolved in the last decade but there’s still a long way to go, and even customers who have switched to platforms like Wise and PayPal are paying significant and unjustifiable fees. Unlike our competitors, we are not subsidising costs associated with products and services that our customers have little interest in. It’s a simple pitch - with Atlantic Money all transfers up to £1,000,000 receive the live mid-market currency rate for a flat fixed-fee of £3, delivering savings of up to 99% versus all our competitors.”

— Patrick Kavanagh, Co-Founder of Atlantic Money

“We set out with the goal of creating a money transfer app for people like me and Patrick who, having moved overseas for work, are sending money back home regularly. We’ve built new technology that links global currencies more efficiently than ever before, substantially reducing transaction costs and offering a friction-free customer experience. This allows us to upend the traditional pricing models used by our competitors by passing on institutional pricing to our customers, all with the beautiful user experience of a product designed to do one thing perfectly.”

— Neeraj Baid, Co-Founder of Atlantic Money

Helping Atlantic Money execute on its mission are some of the world's best investors including Amplo, Ribbit, Index Ventures, 20VC, Kleiner Perkins, Elefund, and Day One Ventures alongside its own global team of finance and technology experts from global giants including Robinhood, Wise, Amazon, Tinkoff, Monzo and Capco.

“Atlantic Money is laser-focused on eliminating excessive fees for people regularly sending money abroad, while making the user experience frictionless. The digital innovation of the past decade has started to disrupt the money transfer market, but more than 90% of customers globally still use legacy solutions. Even those using modern solutions are charged opaque volume-based or tiered fees that can change over time and across geographies. Atlantic’s novel approach gives customers a simple, transparent fixed fee per-transaction, with zero FX markup, no matter when or where customers are sending their money or how much they are sending. This dramatically undercuts the incumbents, particularly for customers sending significant amounts abroad.

“Patrick, Neeraj and team have deep experience working in fintech. As leaders in the first wave of innovation that has started to change the financial services landscape, they understand the complexities of running regulated, compliant businesses and also the opportunity to use technology to bring greater value to consumers. We’re excited to see them using that expertise to create products that deliver even more transparent and lower-cost financial services in a critical part of the market.”— Nick Shalek, General Partner at Ribbit Capital