Atlantic Money receives green light for expansion across US, Canada and Australia

February 6, 2024

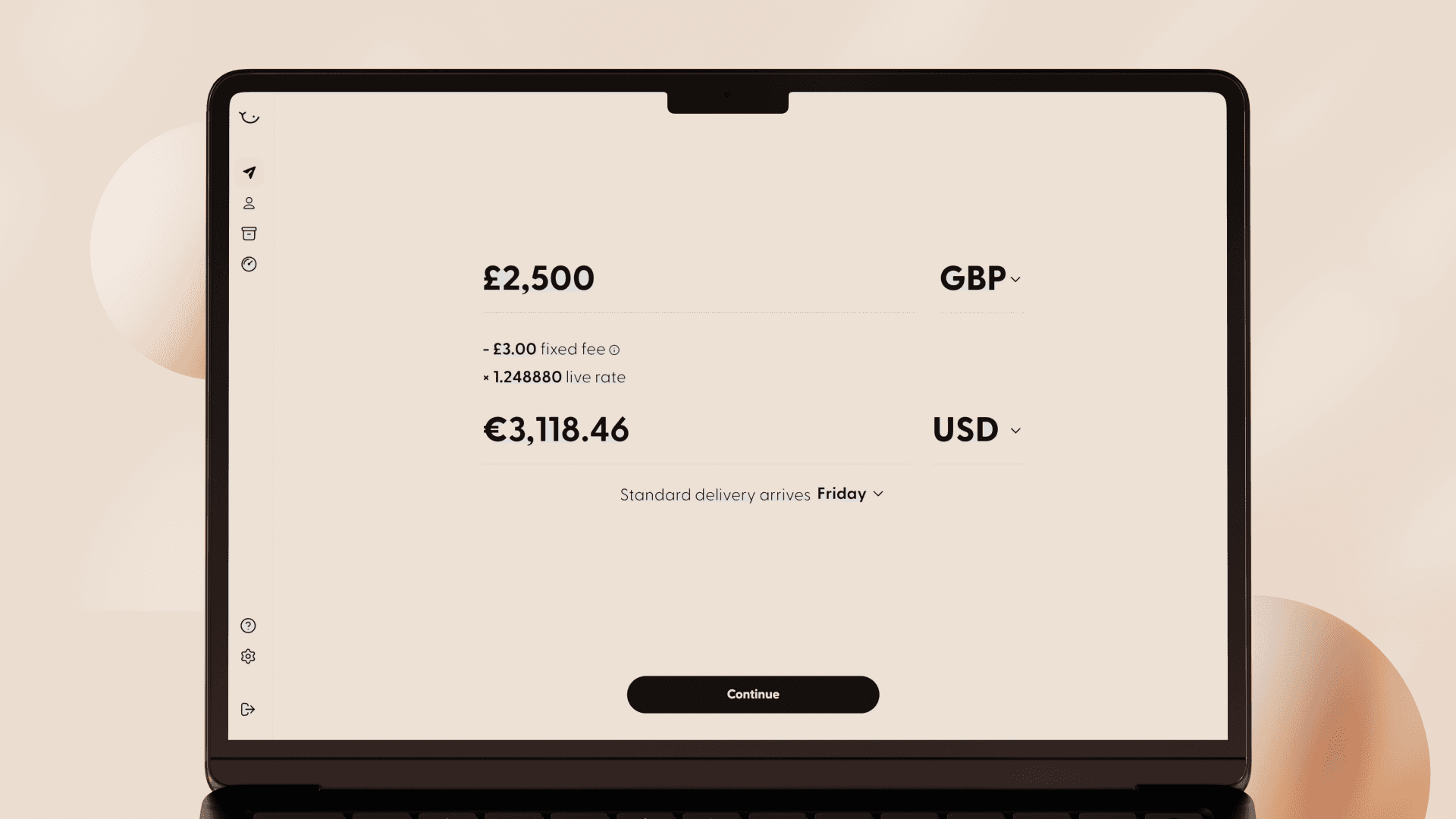

Users will be able to send up to $1m abroad for a fixed fee at the current exchange rate

Since its launch in July ‘22, the firm has transferred over £300m of customer funds, a 100% increase in the past 6 months

Atlantic Money also recorded more than 10,000 users transferring a median of £3,000

UK fintech, Atlantic Money is set to offer its fixed-fee money transfers across additional major markets.

Within 1.5 years of launching in the UK, Atlantic Money has met relevant requirements to offer its services in the United States, Canada and Australia. Users will be able to transfer up to $1 million abroad at the current exchange rate and for Atlantic Money’s flat fixed fee.

In Canada and Australia, the firm itself has successfully registered to offer money transfer services to individuals and businesses. In the United States, Atlantic Money is registered as a federal Money Services Business with FinCEN and will offer its services to businesses under the sponsorship of a federally regulated US bank.

The demand for a fixed fee transfer solution in these new markets is substantial, with over $100 billion in annual transfers according to the World Bank. In contrast, UK outbound transfers totalled $11 billion. However, these personal transfers make up only a fraction of global transactions as research has shown.

“Operating with the full trust and confidence of our partners and regulators has always been central to our mission of serving customers with reliable, secure fixed fee transfers. We are excited to have gained these approvals so quickly, and are looking forward to offering our services in these new major regions.”

— Neeraj Baid, CEO and Co-founder of Atlantic Money

In 2022, Atlantic Money received regulatory permission from the British Financial Conduct Authority (FCA) and Belgium’s National Bank (NBB), enabling its fixed fee transfers across the UK and the EU.

Since then, the fixed fee money transfer provider has facilitated over £300 million for businesses and individuals, representing a 100% growth in volume in the past 6 months.

Today, over 10,000 users rely on Atlantic Money's fixed fee transfer, transmitting a median of £3,000. Compared to formerly low-cost providers, such as Wise, Atlantic Money is on average 10 times cheaper when transferring money abroad.

Compared to formerly low-cost providers, such as Wise, Atlantic Money is on average 10 times cheaper when transferring money abroad.