Currency surcharges on international purchases

December 20, 2023

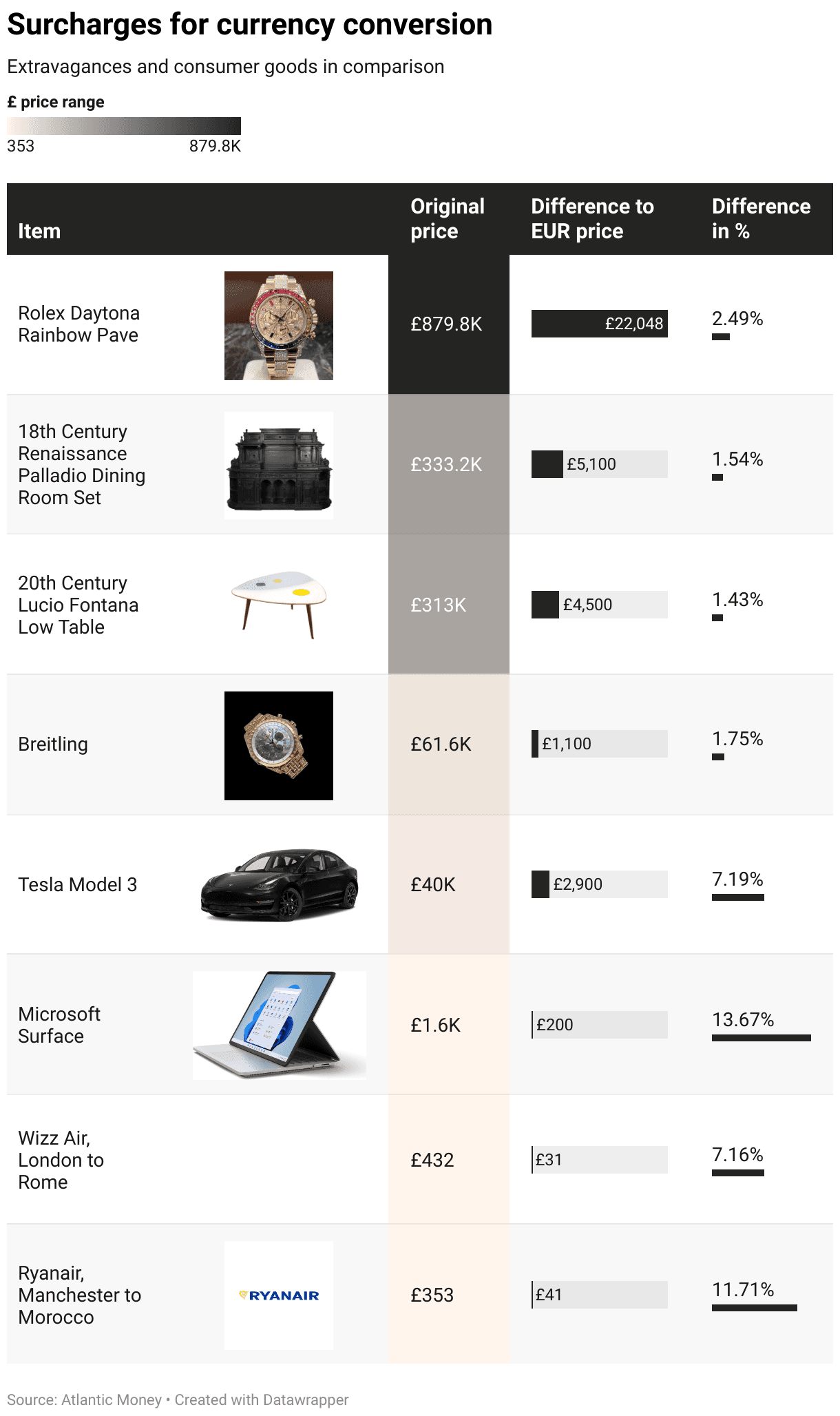

International money transfer provider, Atlantic Money, has compared purchase prices in various random samples across currencies and borders, uncovering unnecessary extra costs consumers often unwittingly pay.

Focusing on luxury items to demonstrate the impact, Atlantic Money analysed the same listings for pound and euro payments. A rare Rolex Daytona watch saw a 2.5% markup in GBP, equating to over £22,000. An 18th-century Renaissance Palladio dining set faced a 1.5% premium of around £5,100. A low table by Lucio Fontana from the 20th century is £4,500 more expensive (1.3%) for GBP payments.

Such increased costs were not limited to just extravagances. Tech purchases like a Tesla or a Microsoft Surface laptop saw markups of 7.19% (£2,900) and 13.67% (£200) respectively compared to a euro country.

Atlantic Money also found considerable price increases when paying for services in the UK in a different currency like the euro, which is common for commuters. Flying London to Rome with Wizz Air increased by 11.6% in euros. A Ryanair flight from Manchester to Marrakesh (Morocco) saw a 7.2% surcharge.

These extra charges negatively impact consumer value and trust, according to Atlantic Money CEO Neeraj Baid:

“It is a fact that international purchasers often unwittingly incur substantial additional costs merely for currency conversion.

The surcharges do not necessarily have to come from direct providers such as online retailers. We have observed that the large payment providers in the market charge enormous percentage surcharges for currency exchange alone. For a service that is actually almost free.”— Neeraj Baid, Co-Founder and CEO of Atlantic Money

Not all tested platforms exhibited marked-up prices. For example, sneaker resellers, where rare items can score a million valuations, showed no euro-pound differences. Major jewellery retailers also had negligible variances after currency conversion in sampled items.