Atlantic Money starts fixed fee transfers to India

June 12, 2023

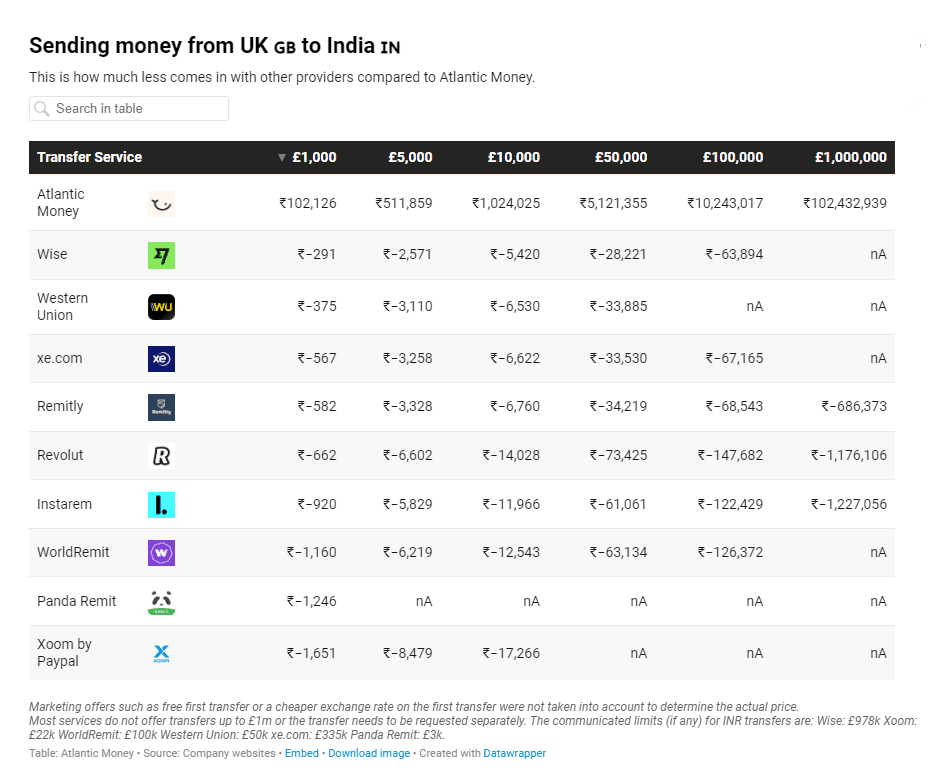

Fixed fee money transfer provider, Atlantic Money, opens its service to the largest target market for international transactions, India. Users can now transfer up to £1m or €1m to Indian Rupee and benefit from Atlantic Money's innovative pricing structure – undercutting the formerly cheapest options by up to 99%.

With India being expected to have become the first nation in the world to reach US$100 billion in remittances in 2022, Atlantic Money is enabling potential savings of over £1.3 billion* through its competitive pricing. The company aims to even enhance these savings in the future.

The possible improvement stems from the current pricing structure for the Indian rupee. Like the other currencies, Atlantic Money offers its international transfers to India at its unique fixed fee of £3. But due to the nature of the INR FX market, the money transfer provider has to use an exchange rate that is for the first time slightly different from the current rate one can find on Google. The company passes this institutional rate directly on to the consumers without any profit and aims to close the difference as soon as possible.

Ultimately, Atlantic Money saves its users up to over ₹1m (£9,5k) per transfer compared to formerly best services and is far below 5.41%, the World Bank's average price for remittances in Indian rupee.

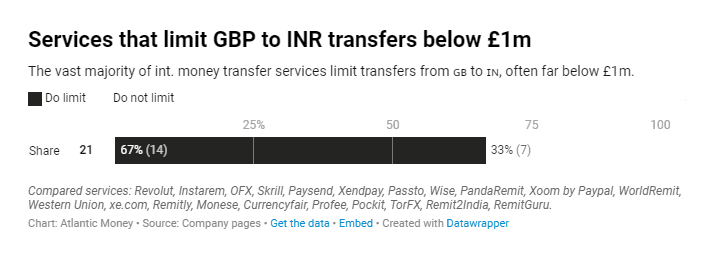

With its new remittances to India, Atlantic Money not only improves the Indian rupee pricing structure but is also one of the few providers to offer transactions of almost any size. As a comparison of 21 digital providers for foreign transfers to India reveals, two-thirds of the companies limit transactions for their users, up to maximum amounts as low as £3,000. Atlantic Money offers its transfers to India for up to £1m or €1m.

Indian Rupee is the first new currency in Atlantic Money's offering since its official launch in July 2022. The fixed fee money transfers are currently available in 29 countries across Europe for transfer from British Pound or Euro to major global currencies.

“India, as the biggest target for money transfers in the world, is especially burdened with excessive variable fees, causing significant financial strain. Today, we are proud to end this era of arbitrary charges by introducing our fixed fee transfers to India. Our users can now enjoy savings of up to 99% compared to alternative options, making transfers to Indian Rupee more affordable and accessible than ever before.”

— Neeraj Baid, CEO and Co-Founder of Atlantic Money

*The sum is derived from the remittance volumes of the sending nations covered by Atlantic Money as well as the respective average prices of the World Bank for the currency pairs, which were subsequently offset against the costs of Atlantic Money.