1 year Atlantic Money: £160m in volume and £750k in savings

July 21, 2023

Atlantic Money, the provider of fixed fee international money transfers, today marks its one-year anniversary by releasing its inaugural company figures. The fintech has achieved significant milestones in both transfer volume and cost savings, solidifying its position in the market.

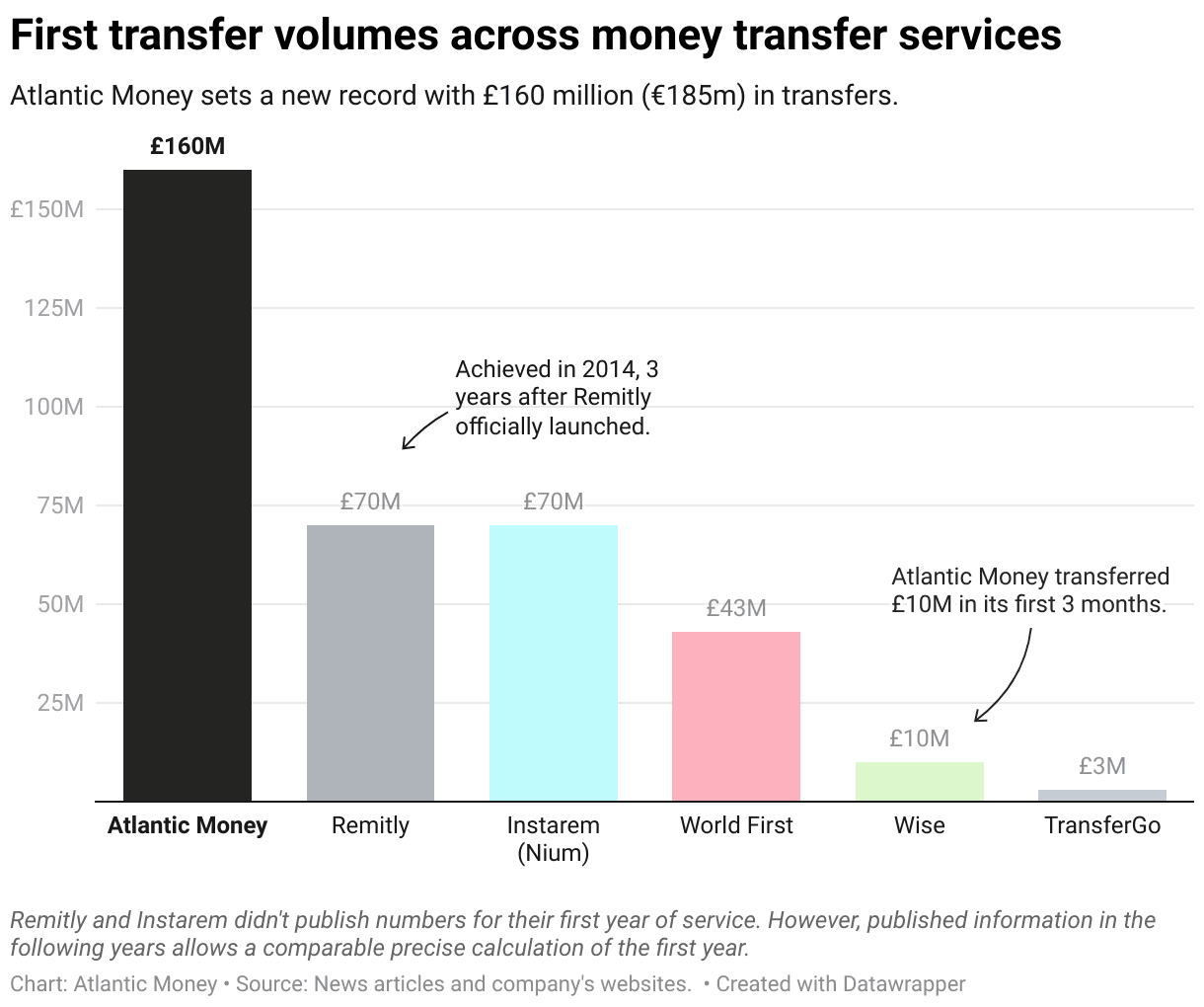

During its first year of operation, Atlantic Money facilitated over £160m in transfers. This achievement showcases the effectiveness of Atlantic Money's unique selling proposition of fixed fee transfers, which provide users with consistent and affordable pricing.

The company's performance in its debut year extends beyond transfer volume. Atlantic Money's customers also enjoyed substantial savings in fees, totalling more than £650,000, thanks to the company's flat fixed fee pricing model.

To put these numbers in perspective: Comparable providers such as CurrencyFair, Wise, Remitly and others did not come close to a similar transfer volume in their first year. Thus, having sent over £160m in its first year, Atlantic Money is believed to have had the strongest debut year ever among money transfer services.*

Furthermore, the savings figure of £650,000 is based on comparisons with former low-cost providers. Savings compared to traditional players, such as banks, are multiple times greater. To demonstrate the stark contrast in pricing, Atlantic Money provides a transparent price comparison tool for comparing with Wise which was known to be a low-cost provider.

“We founded Atlantic Money to address the issue of expensive variable pricing in the international money transfer market. Our first-year figures demonstrate our success in taking this crucial first step and highlight our operational efficiency. Today, people in 32 countries are utilizing our unique flat fee service to send money abroad. With more to come.”

— Neeraj Baid, Co-Founder and CEO of Atlantic Money